FINANCE PROCESS

Getting finance from SME Leasing and Finance is easy and quick. We will be able to help you arrange the finance so that you get the equipment you need when you need it!

Acceptance within hours of receiving fully completed application. Once the Finance Company receive your application and have had a chance to process all of your information, an acceptance could be issued within hours.

WHO ARE SME?

SME Finance & Leasing Solutions DAC is an Independent Finance Company that provides funding to the SME sector.

SME Finance & Leasing Solutions DAC will provide funding for a wide variety of assets over their useful economic life and thereby protect valuable working capital for more productive purposes.

WHY USE SME FINANCE & LEASING SOLUTIONS DAC

WHY USE FINANCE?

Application Process and Documents Required:

For an application to be assessed the following information needs to be supplied to the finance company:

Please note if Limited Company: CRO must be up to date for application.

BENEFITS OF SME FINANCE & LEASING SOLUTIONS DAC

THE SERVICE PROVIDED:

The company sources the majority of its business through independent vendors and dealers of Machinery and Equipment. The

funding process is driven by IT and automation which allows for a very professional and efficient service to the SME market place.

KEY FEATURES OF THE SERVICE INCLUDE:

Acceptance within hours of receiving fully completed application. Once the Finance Company receive your application and have had a chance to process all of your information, an acceptance could be issued within hours.

WHO ARE SME?

SME Finance & Leasing Solutions DAC is an Independent Finance Company that provides funding to the SME sector.

SME Finance & Leasing Solutions DAC will provide funding for a wide variety of assets over their useful economic life and thereby protect valuable working capital for more productive purposes.

WHY USE SME FINANCE & LEASING SOLUTIONS DAC

- Professional & Reliable

- Flexible Underwriting

- Attentive Service

- One Stop Shop

WHY USE FINANCE?

- Preserve other credit lines

- Unsecured Facilities

- Ease Cash Flow Worries

- Tax Efficient

- Buy Now – Increase Profitability

- Makes Quality More Affordable

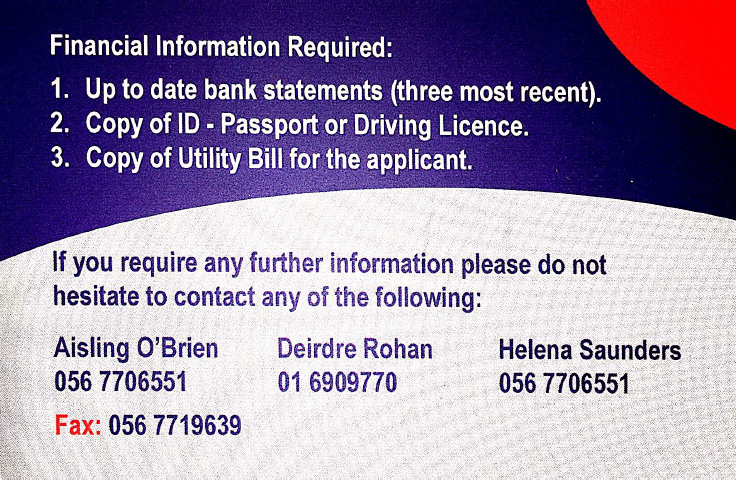

Application Process and Documents Required:

For an application to be assessed the following information needs to be supplied to the finance company:

- Copy of directors/owners most recent three months bank statements (business)

- Copy of director/owners driving licence or passport to have a signature and be in date.

- Copy of a recent utility bill dated within the last six months as a proof of address for example an

electric, phone (landline/mobile), Gas, Waste & Recycling, Bank Statement (not statement that is

being presented for underwriting purposes) TV Licence, Revenue Correspondence i.e. tax credits,

current car or home insurance policy that shows directors/owners home address.

Please note if Limited Company: CRO must be up to date for application.

BENEFITS OF SME FINANCE & LEASING SOLUTIONS DAC

- Fund 100% of purchase cost.

- Finance range from €1k - €35k plus + vat.

- Fast and Efficient Credit Risk Assessment on all applications.

- Credit Risk Assessment completed in house by our Underwriting Team.

- Fixed Rentals.

- New & Used Equipment funded.

- Nationwide Coverage.

THE SERVICE PROVIDED:

The company sources the majority of its business through independent vendors and dealers of Machinery and Equipment. The

funding process is driven by IT and automation which allows for a very professional and efficient service to the SME market place.

KEY FEATURES OF THE SERVICE INCLUDE:

- Streamlined application process

- Automated systems

- Approval at the point of sale

- Minimal underwriting criteria

- Asset based lending focused

| ||||||||